Research and development partnerships from Birmingham City University (BCU) can deliver exciting new solutions to current challenges. Want an example? Find out how CPD business courses from BCU have helped major car manufacturers make the transition to electric vehicles.

What is Research and Development (R&D)?

Innovation and development across industries are mostly dependent on research and development (R&D), which is the methodical and creative pursuit of knowledge expansion and technical growth.

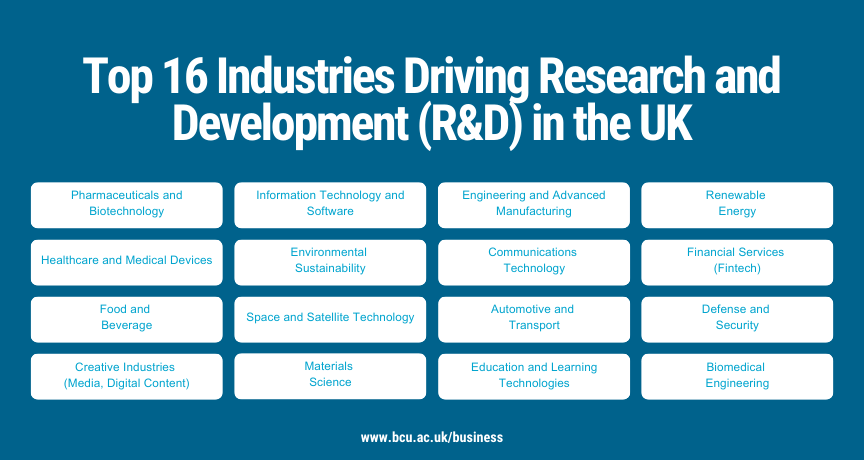

The UK’s R&D spending has changed significantly in recent years, indicating both higher investment and strategic realignment within important industries. R&D departments drive future growth by providing insights into the market, developing new products and services, and improving existing ones to meet market needs and quality standards.

Total R&D Expenditure and Growth

After making revisions to its methodology, the Office for National Statistics (ONS) was able to determine that R&D investment had increased significantly in recent years. For example, R&D investment in 2021 was predicted to be £66.2 billion under the new strategy, compared to £38.5 billion under the former approach in 2019.

This change in methodology emphasises a more thorough evaluation of R&D operations and highlights their wider economic impact. R&D tax credits can guide businesses new to R&D and support their future investment goals.

Government Targets and Sectoral Contributions

The UK government has set high goals for research and development (R&D) spending, hoping to achieve 2.4% of GDP by 2027. R&D spending has already surpassed the original goal and now represents between 2.9% and 3% of GDP. This pledge demonstrates how important research and development is to the government’s agenda for competitiveness and economic growth.

The business sector was crucial in 2021, accounting for £38.7 billion (59%) and £46.9 billion (71%) of all R&D activities carried out in the UK. In the meantime, the public sector—which includes the government and universities—contributed £12.8 billion (19%) and £5.6 billion (8%), respectively, to the field of research and development. This cross-sectoral endeavour demonstrates a coordinated national policy to promote innovation and information sharing. Scientific research plays a significant role in enhancing a company's performance, highlighting the correlation between persistent R&D strategies and outperforming firms.

International Benchmarking

Internationally, the UK remains a strong performer in R&D expenditure relative to its GDP. Compared to OECD and EU averages, the UK's R&D spending ranks favourably, underscoring its competitive position among G7 nations. Globally, companies such as AstraZeneca and GSK lead R&D spending in the UK, demonstrating robust private sector commitment to innovation and scientific advancement.

Section 1: Understanding Research and Development

Definition and Scope

Research and Development (R&D) encompass systematic activities undertaken to create new knowledge or enhance existing knowledge in order to develop new products, processes, or services. It addresses scientific, technological, or industrial difficulties by combining theoretical and practical efforts across multiple fields.

R&D also encompasses technological development, which refers to the innovative activities undertaken by corporations in developing new services or products. Two primary categories can be used to broadly classify R&D:

-

Basic Research: A research initiative with no particular practical application in mind, its goal is to further our grasp of the fundamentals of science. It investigates the fundamental ideas and rules of nature, and is frequently carried out in educational or scientific settings.

-

Applied Research: Using current scientific knowledge to create new goods, procedures, or services is the goal of applied research. It fills the gap between academic understanding and real-world applications by concentrating on certain objectives like increasing productivity, creating new technologies, or resolving real-world issues.

Scientific or Technological Uncertainty

Scientific or technological uncertainty refers to situations where knowledge does not exist or is inadequate regarding the outcome of an R&D project. This uncertainty results from the project's novelty or complexity, which makes it challenging to make firm predictions about its outcomes up front. A key component of R&D is addressing uncertainty, since it entails investigating novel concepts, tools, or techniques that could result in game-changing discoveries.

Managing uncertainty in research and development (R&D) initiatives entails methodical inquiry, testing, and hypothesis validation to lower risks and increase the probability of positive results.

In order to overcome uncertainty and make major gains, organisations that participate in research and development (R&D) frequently devote resources to pushing the boundaries of current knowledge and exploring new horizons.

Section 2: Financial Incentives for R&D in the UK

R&D Tax Relief and Tax Credits

In the United Kingdom, Research and Development (R&D) tax relief and tax credits are essential financial incentives designed to encourage innovation and technological advancement among businesses. HM Revenue & Customs (HMRC) is in charge of administering these incentives, which offer significant advantages to businesses carrying out qualifying R&D activities. The R&D tax claim can include work undertaken for a client, and the project doesn't have to be successful to qualify.

Purpose and Benefits

R&D tax relief allows eligible companies to deduct an additional percentage of their qualifying R&D costs from their taxable profits. There are two types of R&D tax relief schemes in the UK:

-

Small and Medium-sized Enterprises (SME) Scheme: SMEs can claim R&D tax relief as a tax deduction of up to 230% of their qualifying R&D expenditure. This means for every £100 spent on qualifying R&D costs, an SME can deduct £230 from its taxable income, in addition to the £100 spent. Changes to R&D tax relief rates can be based on the starting date of accounting periods.

-

Research and Development Expenditure Credit (RDEC) Scheme: Larger companies and SMEs who do not qualify for the SME Scheme can claim RDEC. RDEC is a taxable credit calculated at 13% of the company’s qualifying R&D expenditure. This credit can either be used to reduce the company’s tax liability or be claimed as a cash payment.

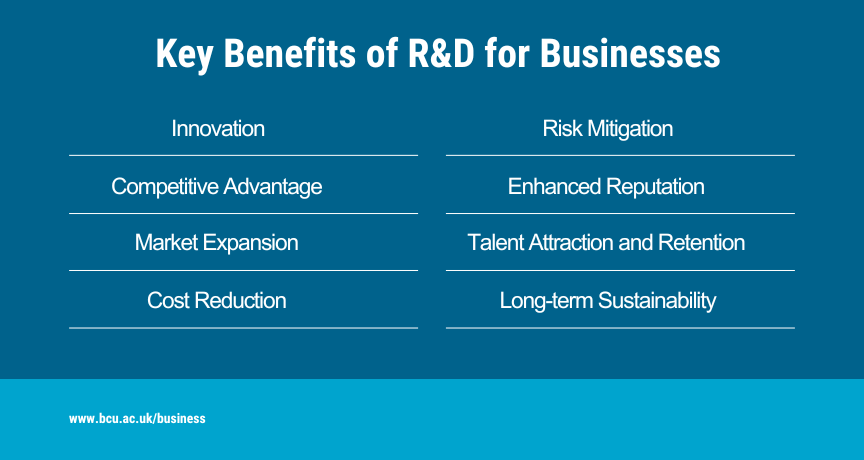

Both schemes aim to reduce the after-tax cost of R&D, providing businesses with crucial funding to reinvest in further innovation and development. Certain regulations or actions related to tax relief come into effect for accounting periods beginning on specific dates.

What Qualifies as R&D Expenditure

For expenditure to qualify under the R&D tax relief schemes in the UK, it must meet specific criteria:

-

Staff Costs: Including salaries, wages, employer NICs, and pension contributions for employees directly engaged in R&D activities.

-

Consumables and Materials: Such as software, utilities, and materials used directly in R&D activities.

-

Subcontracted R&D: Payments made to third parties for R&D work on behalf of the claiming company.

The key requirement is that the R&D activities must seek to achieve an advance in science or technology through the resolution of scientific or technological uncertainties.

Benefits of R&D Activities for Tax Purposes

Engaging in R&D activities can lead to several tax benefits for companies in the UK:

-

Reduction in Tax Liabilities: By deducting R&D expenditure from taxable profits, companies can effectively reduce their corporation tax liabilities.

-

Enhanced Cash Flow: SMEs can benefit from enhanced cash flow by claiming R&D tax credits, either as a reduction in tax liability or as a cash payment from HMRC.

-

Encouragement of Innovation: The availability of R&D tax relief schemes encourages companies to invest in innovative projects that may otherwise be financially challenging.

Section 3: Claiming R&D Tax Credits

Process Overview

Claiming Research and Development (R&D) tax credits in the United Kingdom involves several key steps to ensure eligible businesses receive financial incentives for their innovative activities. Here’s an overview of the process:

-

Identifying Qualifying Activities: Determine which of your company’s activities meet the criteria for R&D as defined by HM Revenue & Customs (HMRC). These activities must seek to achieve an advance in science or technology through resolving scientific or technological uncertainties.

-

Calculating Qualifying Expenditure: Compile and calculate the total expenditure incurred on qualifying R&D activities. This includes staff costs, consumables, subcontracted R&D, and certain overheads directly related to the R&D project.

-

Preparing Documentation: Gather all necessary documentation to support your R&D tax credit claim. This typically includes project descriptions, technical summaries, financial records, and evidence of qualifying expenditure.

-

Submission to HMRC: Complete the appropriate R&D tax credit claim forms and submit them to HMRC. Claims can be made annually as part of the company's corporation tax return.

-

Review and Assessment: HMRC will review your claim to make sure it complies with the eligibility requirements and has enough supporting documentation. They may request additional information or clarification during the assessment process.

-

Receiving Benefit: Upon approval, eligible companies will receive R&D tax credits either as a reduction in their corporation tax liability or as a cash payment, depending on the scheme they qualify for (SME Scheme or RDEC).

Claim Notification Form

The claim notification form is a crucial initial step in the process of claiming R&D tax credits. Here’s why it’s important and how to proceed:

-

Importance: Submitting a claim notification form informs HMRC of your intention to claim R&D tax credits. It provides them with an early indication of your company’s R&D activities and expenditures.

-

Process: The claim notification form is typically submitted alongside your corporation tax return. It outlines the estimated expenditure on R&D activities for which you intend to claim relief.

Tax Credit Claim

Claiming R&D tax credits involves specific steps and documentation to ensure compliance and eligibility:

-

Documentation: Prepare detailed documentation supporting your claim, including project descriptions, technical justifications, and financial records of qualifying expenditure.

-

Form Submission: Complete the relevant R&D tax credit claim forms, such as CT600 for SMEs or RDEC tax credit form for larger companies. Include all required information and submit them with your corporation tax return.

-

Claim Review: HMRC will review your claim and determine whether your R&D activities meet the eligibility requirements and if your expenditure has sufficient supporting documentation.

-

Outcome: If your claim is approved, HMRC will issue R&D tax credits. SMEs can benefit from enhanced deductions against taxable profits or, alternatively, cash payments. Larger companies eligible for RDEC will receive a taxable credit.

Amended Claim

If you need to amend your R&D tax credit claim:

-

Reasons for Amendment: Amendments may be necessary if there are errors or omissions in your original claim or if additional qualifying expenditure is identified after the initial submission.

-

Process: Submit an amended R&D tax credit claim form to HMRC, detailing the changes and providing supporting documentation as required.

-

HMRC Review: HMRC will review your amended claim and may request further information or clarification before making a decision.

-

Effect: Upon approval, any adjustments to your claim will be reflected in your corporation tax liability or cash payments, ensuring accurate recognition of your R&D expenditure.

Section 4: Specific Provisions and Expenditures

SME Scheme and Larger Companies

-

SME Scheme:

-

Definition: The SME (Small and Medium-sized Enterprises) scheme is designed for companies with fewer than 500 employees and either annual turnover under €100 million or a balance sheet total under €86 million.

-

Benefits: SMEs can claim enhanced R&D tax relief of up to 230% on qualifying R&D expenditure. This means that for every £1 spent on qualifying R&D activities, SMEs can deduct £2.30 from their taxable income or potentially receive a cash payment if the company is loss-making.

-

Cash Payments: If an SME is making a loss, they can surrender their R&D tax credit for a cash payment, helping to support cash flow and further investment in innovation.

-

Research and Development Expenditure Credit (RDEC) for Larger Companies:

-

Definition: Larger companies that do not qualify for the SME scheme can claim under the RDEC scheme.

-

Benefits: RDEC provides a taxable credit calculated at 13% of qualifying R&D expenditure. This credit can be used to reduce the company's tax liability or, for some companies, be surrendered for a cash payment.

Qualifying Indirect Activities

-

Definition: Indirect activities that can qualify for R&D tax relief include supporting activities necessary for the R&D process but not directly engaged in the core R&D itself.

-

Examples: These may include activities such as administrative support, technical analysis, or testing required to support R&D projects.

-

Criteria: Indirect activities must be directly attributable to the R&D project and must not be of a routine nature or related to commercial production.

Externally Provided Workers and Cloud Computing Costs

-

Externally Provided Workers (EPWs):

-

Definition: EPWs are individuals who are not employees of the company but are engaged through a third-party provider to work on R&D projects.

-

Claiming Costs: Companies can claim the costs of EPWs involved directly in R&D activities, including their salaries, NI contributions, and any agency fees incurred in engaging them.

-

Criteria: EPWs must be directly engaged in qualifying R&D activities and not in routine or administrative tasks.

-

Cloud Computing Costs:

-

Definition: Costs associated with cloud computing services used directly in R&D activities can be eligible for R&D tax relief.

-

Eligible Costs: This includes expenses related to the use of cloud infrastructure, platform services, and software tools specifically used for R&D purposes.

-

Documentation: It is essential to document how cloud computing services are directly linked to R&D projects and the specific nature of the services provided.

Section 5: Birmingham City University's Impactful R&D Projects

Birmingham City University (BCU) is actively engaged in a diverse array of Research and Development (R&D) initiatives, each contributing significantly to advancing knowledge and addressing real-world challenges. Here are examples of some of our impactful R&D activities:

Industry-led Research

BCU’s R&D efforts are driven by the needs of industry, aiming to generate new knowledge and deliver tangible benefits to culture, industry, society, and the environment. This approach ensures that our research remains relevant and impactful within our regional and global contexts.

Research Centres

BCU hosts specialised research centres focused on addressing critical local, national, and global challenges. These centres align closely with the university’s strategic priorities and research strategy, enriching both student learning and societal impact.

R&D Partnerships

Collaborating extensively with local, national, and international businesses and organisations, BCU undertakes R&D activities that result in practical solutions and impactful outcomes. These partnerships are integral to fostering innovation and addressing complex societal and industrial challenges.

Examples of R&D Projects at BCU:

-

Co-generating Knowledge to Adapt to Environmental Change: This project aims to enhance planning and governance of dynamic landscapes by co-generating knowledge about environmental change. It focuses on stakeholder engagement to foster effective policy implementation and sustainable landscape management.

-

Enabling Social Change through Alternative Dispute Resolution: BCU’s research in this area explores mediation, alternative dispute resolution, and participative approaches to resolving housing, property, and other disputes. Our work spans global collaborations, integrating legal and community-driven solutions to promote social justice and change.

-

Understanding Changing Values around the Built and Natural Environment: Investigating societal values related to the built and natural environment, this research explores collaborative valuation techniques and cultural perspectives. It informs national policy-making on sustainable land management and ecosystem services.

-

Blockchain Solution for an Open-Access Fintech Bank: Addressing challenges and opportunities in fintech, this project examines the welfare gains and adoption challenges of blockchain technology in creating open-access financial solutions.

Section 6: Future Trends and Developments in R&D Tax Relief

As the landscape of research and development (R&D) evolves, so do the frameworks and incentives designed to support innovation through tax relief. The UK government continues to refine and expand these initiatives, reflecting broader economic priorities and technological advancements. Here’s a look at some future trends and developments in R&D tax relief:

1. Enhanced Support for Climate and Sustainability Initiatives

There is a growing emphasis on R&D efforts that promote sustainable development and climate resilience. Companies who develop eco-friendly technologies, renewable energy solutions, and sustainable manufacturing methods should expect increased incentives customised to their priorities.

2. Expansion of Digital and AI Technologies

The digital economy is expanding, fuelled by advances in artificial intelligence (AI), machine learning, and digital transformation. R&D tax relief policies are anticipated to develop to fit the rapidly growing digital sector, boosting investment in AI-driven technologies, cybersecurity advancements, and digital infrastructure.

3. Support for Health and Life Sciences Innovations

The COVID-19 pandemic highlighted the importance of health and life sciences research and development in global health security. Future R&D tax breaks could favour investments in biotechnology, pharmaceuticals, medical devices, and healthcare advances. This includes funding for research on new vaccinations, treatments, and diagnostic technologies.

4. Streamlined Processes and Accessibility

Recognising the administrative difficulty of seeking R&D tax exemption, future advances may concentrate on reducing application processes and enhancing accessibility. Efforts may include digital platforms for simpler claim submission, clearer standards for qualifying expenditures, and increased assistance for SMEs navigating the claims process.

5. International Collaboration and Harmonisation

As the global economy becomes more integrated, the benefits of international R&D collaboration are becoming more widely recognised. Future developments may include efforts to harmonise R&D tax relief systems across jurisdictions, thereby encouraging cross-border R&D partnerships and information sharing.

Innovating for Tomorrow

Birmingham City University (BCU), stands at the forefront of research and development (R&D), fostering innovation through collaborative partnerships and impactful projects. By aligning our research initiatives with the needs of industries and communities, we not only expand our knowledge but also develop practical solutions to contemporary challenges in environmental sustainability, social justice, and technological innovation.

Explore how Birmingham City University’s R&D capabilities can benefit your organisation or research needs. Whether you seek innovation in environmental sustainability, social sciences, technological advancements, or beyond, we offer collaborative opportunities and expertise to make a meaningful impact.

Contact our specialised R&D teams today to discover how we can support your innovation journey and contribute to positive change in your sector.